2022 Annual Summary

by Tina Fixle, Chief Analytics Officer (CAO)

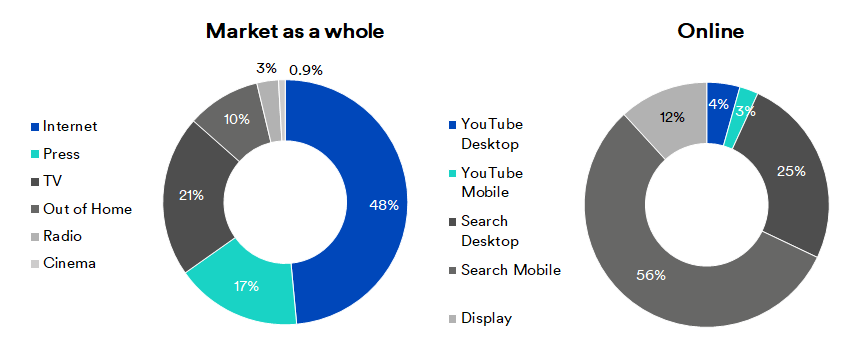

CHF 6.926 million of gross advertising pressure was generated in 2022 (+21.8%). The media channels of global tech giant Google (SEA, YouTube) accounted for around a third of this (35.8%; CHF 2.483 million).

Excluding this advertising space, the gross advertising pressure generated by the media categories of print, TV, radio, cinema, out-of-home and display advertising statistics is CHF 4.443 million.

This corresponds to a 3.8% (+CHF 162 million) increase on the previous year.

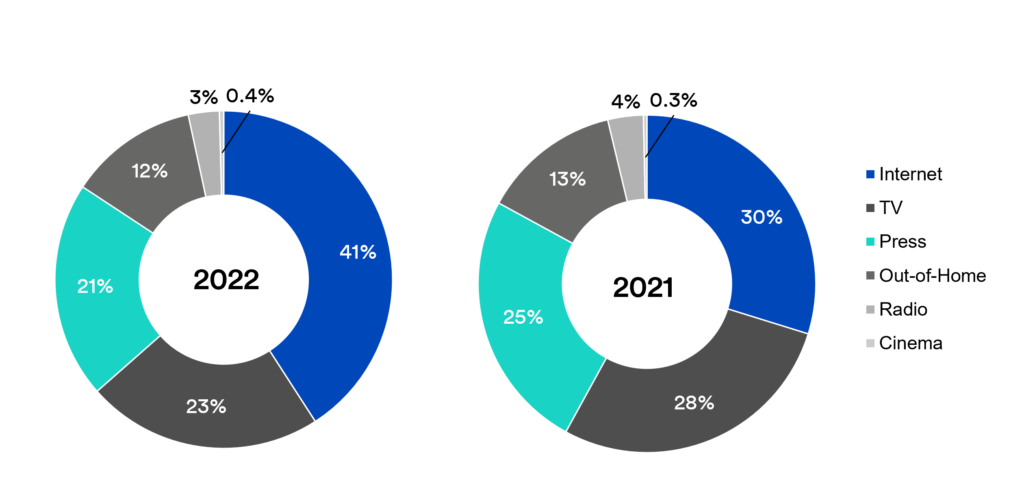

Media mix developments compared to the previous year

Internet will remain the dominant media category in 2022, with a 41% share of the media mix*. TV advertising comes second, at 23%. In third place, print generates around a fifth of the advertising pressure (21%), followed by out-of-home (12%), radio (3%) and cinema (0.4%).

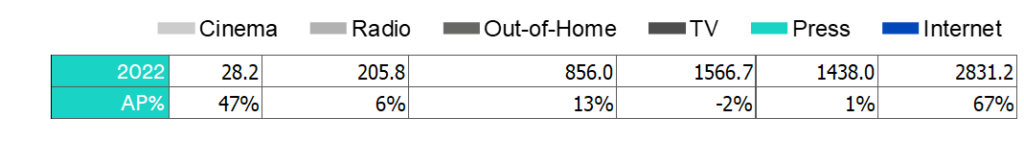

Looking at how advertising pressure has developed in the individual media categories, it is noticeable that only TV advertising is slightly below the previous year’s value (-2.3%). Internet advertising (search, display and YouTube) experienced the greatest growth, at 67.1%. Cinema came second, with growth of 46.8%. The figures are still well below the pre-Covid figures from 2019 (CHF 28 million vs. CHF 49 million), but the trend is heading in the right direction, not least due to the blockbuster movie Avatar 2. Out-of-home completes the list of media groups, with double-digit growth (+13.1%). Following its significant increase last year, radio again grew by 6.3% thanks to the integration of new stations in western Switzerland. Print advertising was also slightly up, at 1.2%.

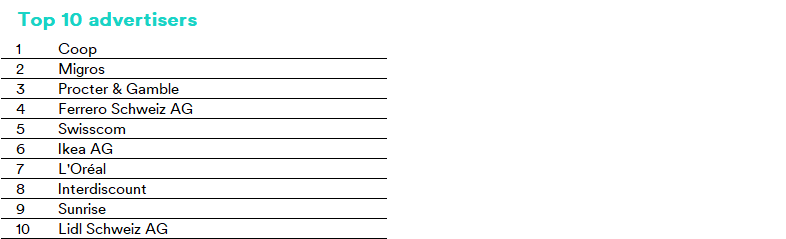

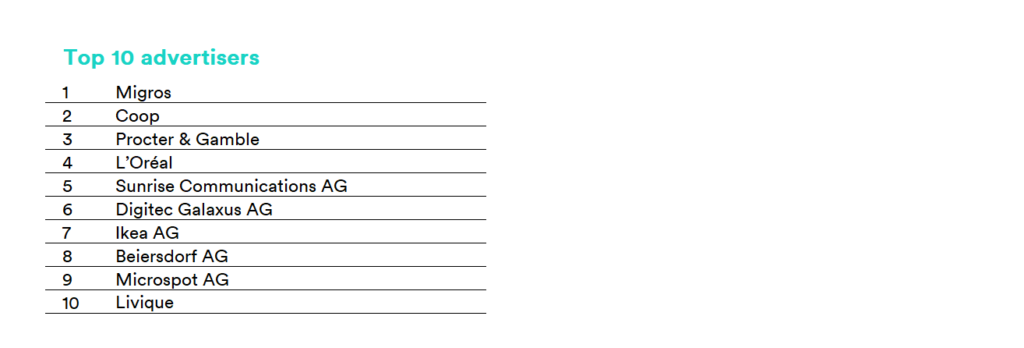

The long tail is growing – top 100 advertisers still generating 42.7% of the advertising pie

In 2022, around 28,400 advertisers in Switzerland placed advertising. Of these, 4,306 were new entries in the statistics in 2022. The growth in online advertising is strengthening long tail advertising. The top 10 advertisers are generating proportionally less advertising pressure than in the previous year (16.4%). In 2021 they accounted for 18.9%, and in 2020 19.3% of the total advertising pressure. The top 20 are still responsible for 22% of the advertising pressure (2021: 24.6%, 2020: 25.1%), the top 100 for 42.7% (2021: 47.4%, 2020: 48.2%).

There is hardly any movement among the leaders of the top 10 advertisers. Coop and Migros remain unchallenged in the top two spots, followed by Procter & Gamble, Ferrero and Swisscom. Contrary to the market trend, the latter three companies reduced their advertising pressure in 2022 compared to the previous year, in some cases significantly (-13.3% to -25.3%).

Ikea (6, 2021: 13) and Sunrise (9, 2021: 17) moved up a few places compared to the previous year. Aldi (2021: 10) did not appear in the top 10 in 2022.

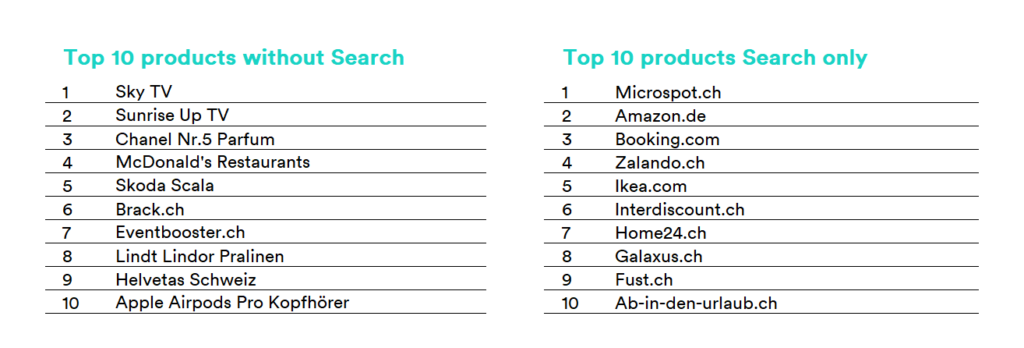

Top advertisers & products

Top advertisers and most advertised products and services (excluding assortment, image advertising and collective categories) 2022.

Coop and Migros leading the pack in sustainability communication

Analysis of the advertising activities of large retailers in Switzerland shows that Coop and Migros are ahead of the competition in 2022 when it comes to advertising communication relating to sustainability issues. Coop (“Actions, not words”) is just ahead of Migros (“Generation M” and “M-Check”). Third place goes to Migros subsidiary Denner (whose slogan translates as “Putting everything into the future”), followed by Lidl (“Said and done”) and Aldi (“Working today for tomorrow”).

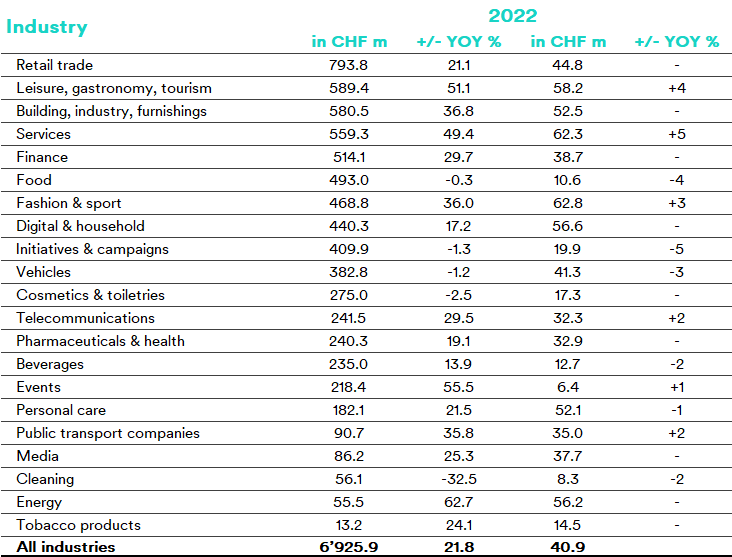

Sector trends in 2022

Retail continues to occupy pole position. In second place is now the Leisure, gastronomy, tourism, which jumped up four places in total compared to the previous year. Only service industry (+5 places) climbed by a higher number of places. This is mainly due to the above-average online focus of these two sectors. In addition, the fashion and sport (+3 places), telecommunications (+2 places), transport companies (+2 places) and events (+1 place) also saw increases.

Initiatives & campaigns recorded the biggest decline, falling five places. The food sector slipped down four places. The vehicle industry dropped three places, followed by beverages (-2 places), cleaning (-2 places) and personal needs (-1 place).

Conclusion

Despite the multi-pronged crisis that the world is undergoing at present (the war in Ukraine, the energy crisis, inflation, etc.) and the general sense of uncertainty, the Swiss advertising market regained strength in 2022. The year-on-year comparison is particularly positive. However, advertising volumes in most media groups, with the exception of out-of-home (with and without the integration of live systems) and online, are still below the values seen before the Covid-19 pandemic.

In addition, advertising activities are increasingly shifting into the digital space, where foreign players skim off the advertising pressure. “Traditional media” will have to come up with strategies if they are not to lose even more relevance.

*To ensure comparability with the previous year, the programmatic data integrated into the display delivery statistics since 2022 were excluded. With these included, the display media category shows an increase of around 30%.

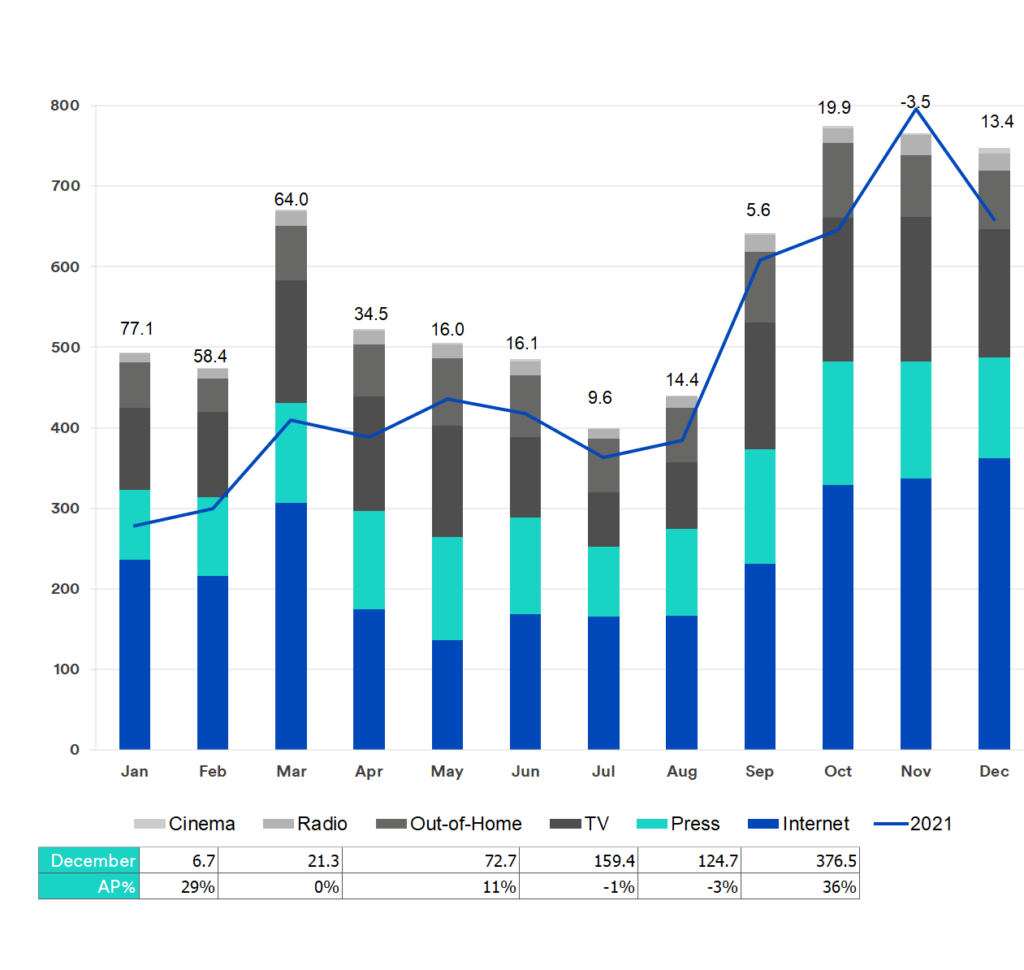

Highlights in December

Compared to the previous year, figures for the month of December are 13.4% higher, with 747.4 million gross advertising pressure. Nevertheless, this trails behind the figure for the same month in 2021, by 2.5%. A total of 15 industries were able to increase advertising pressure again in the final month of 2022. Only six of the 21 sectors reported a decline.

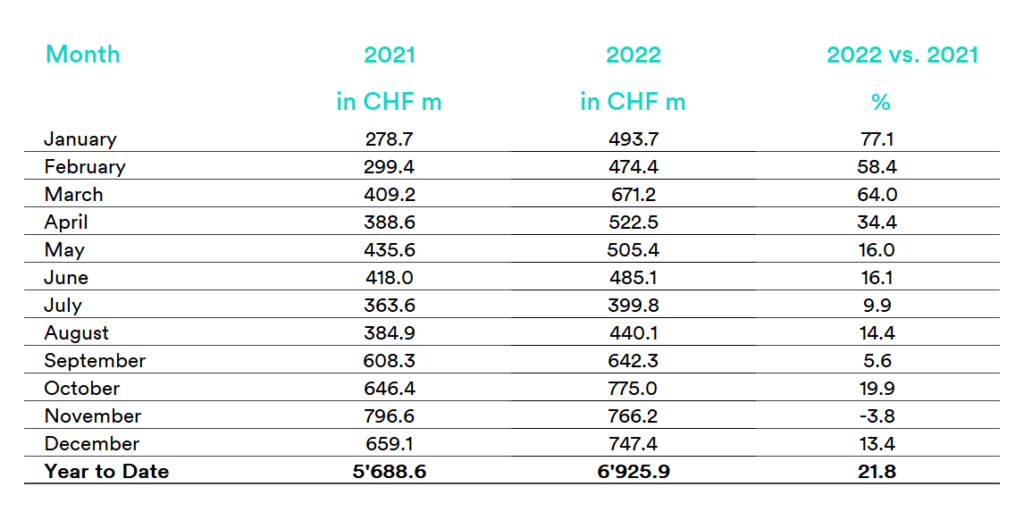

Advertising Pressure in the market as a whole

Development of Advertising Pressure as per December 2022 in million francs (gross)

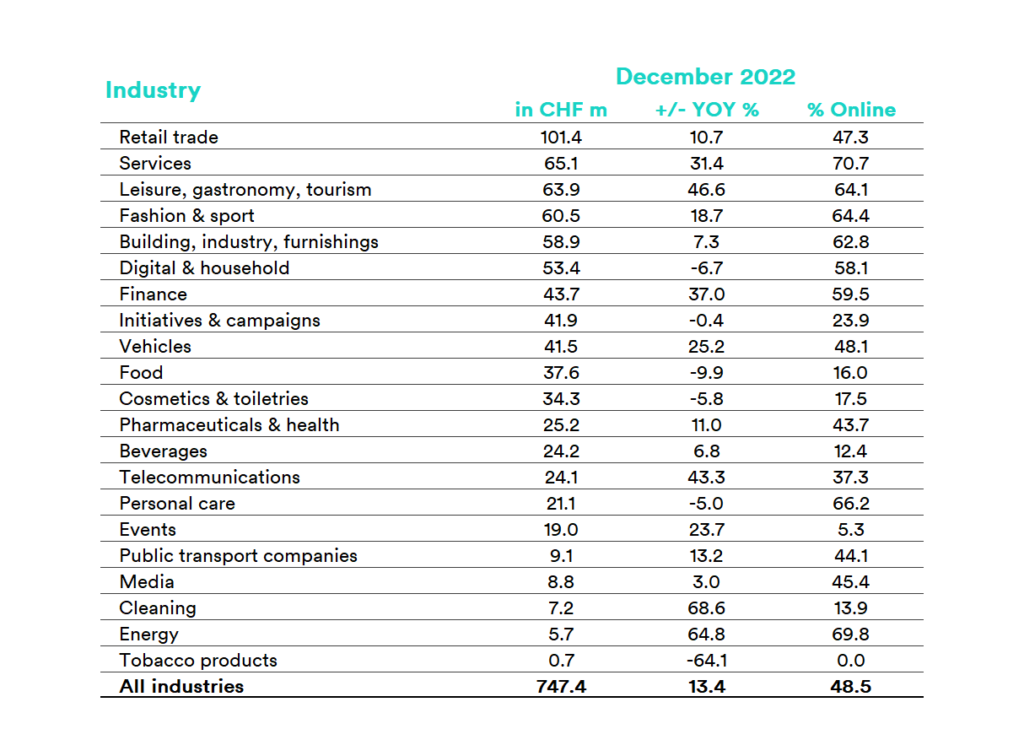

Cleaning sector shows strong growth

In December, the largest increase was achieved by the cleaning sector, with 68.6%. This was closely followed by the previous month’s leader, energy, at 64.8%. Other sectors that were once again able to significantly increase advertising pressure are leisure, gastronomy, tourism (46.6%), telecommunications (43.3%), services (31.4%) and vehicles (25.2%).

Tobacco industry sees over 50% drop in advertising pressure in December

With gross advertising pressure of CHF 1.0 million, the tobacco industry experienced the greatest decrease in advertising pressure when compared against other sectors, at -64.1%. The food (-9.9%), digital & household (-6.7%), cosmetics & personal care (-5.8%), personal needs (-5.0%) and initiatives & campaigns (-0.4%) sectors recorded a much smaller decline.

Top of the month

The top advertisers and most widely advertised products and services (excluding range, image and collective categories) in December

Media Mix

Media Mix for the month of December