Highlights in May 2023

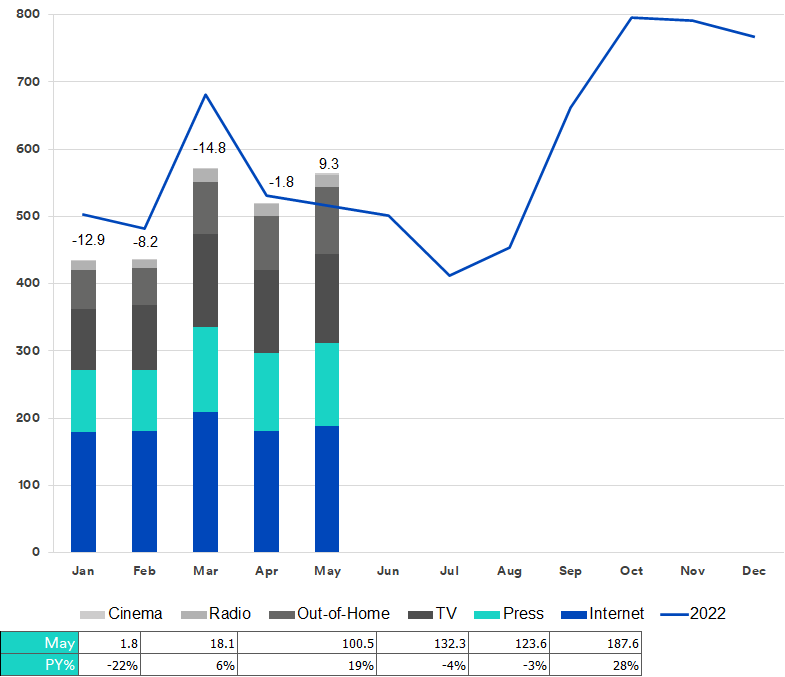

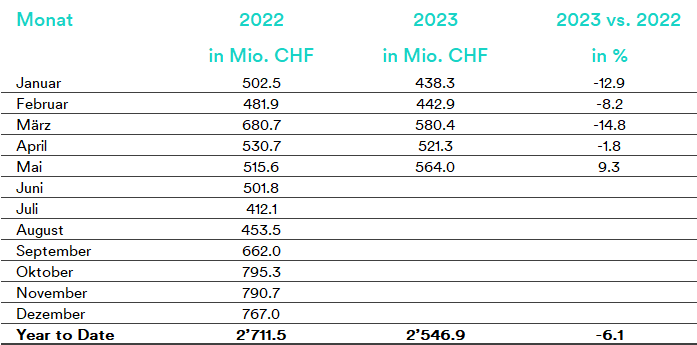

Both billboard advertising (+19%) and online advertising (+28%) drove the Swiss advertising market, resulting in gross advertising pressure of CHF 564.0 million, up 8.2 percent on the previous month. Compared to the previous year, the advertising market recorded an increase of 9.3 percent.

However, advertising pressure for the current year (YTD) is still 6.1 percent behind 2022 at CHF 2,546.9 million gross. In comparison, in 2019, the last year before the slump caused by the coronavirus pandemic, the CHF 3 billion mark had already been exceeded by May. We are eagerly awaiting June and the half-year results.

Advertising pressure in the market as a whole

Advertising pressure development up to May 2023 in CHF million gross

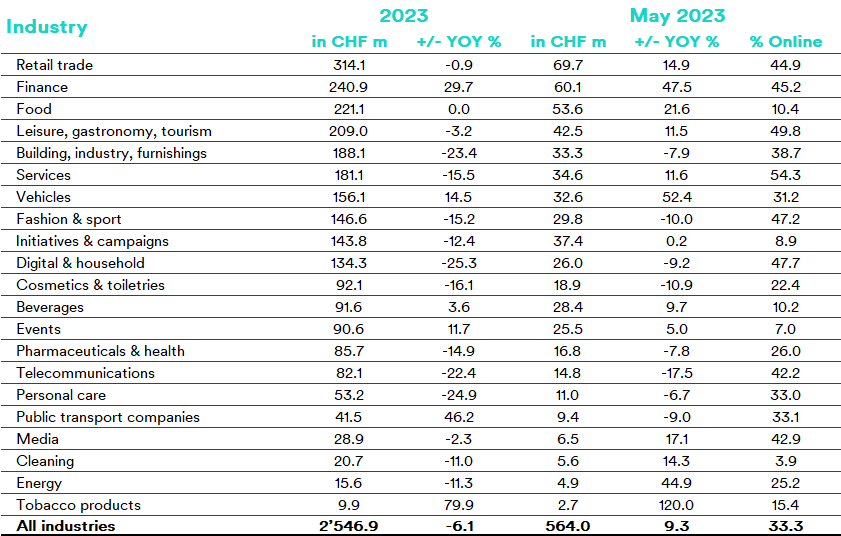

Top three sectors showing stability

A total of 13 industries increased their advertising pressure in May. The top three, retail (+14.9%), finance (+47.5%) and food (+21.6%), were also able to consolidate their leading position in May. As was the case in April, the finance sector was also able to report the third-highest increase in May. Only the tobacco sector (+120%) and the automotive sector (+52.4%) showed even stronger growth.

Other sectors with strong advertising performance in May were energy (+44.9%), media (+17.1%), cleaning (+14.3%) and services (+11.6%).

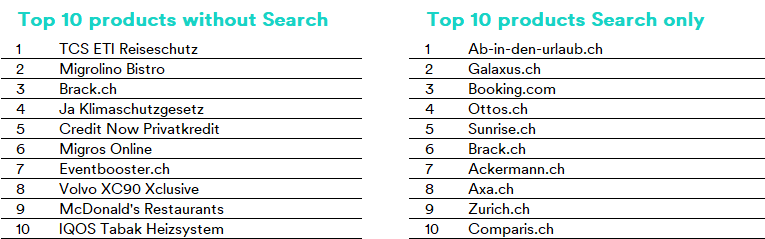

Warmer temperatures make people want to go on vacation, and this is also reflected in the leisure, gastronomy and tourism sector (+11.5%), and the top products with search (Ab-in-den-urlaub.ch) and without search (TCS ETI travel insurance).

Cosmetics and toiletries sees a further reduction

In May, a total of eight industries reduced their advertising pressure, although only three showed a double-digit reduction.

The telecommunications sector recorded the highest reduction with a drop of 17.5%. The cosmetics and toiletries sector also reduced its advertising pressure, as in April, recording a decrease of 10.9%. The third highest reduction was recorded in the fashion and sport sector, with a decrease of 10%. Interestingly, all three sectors also reported a year-on-year decline.

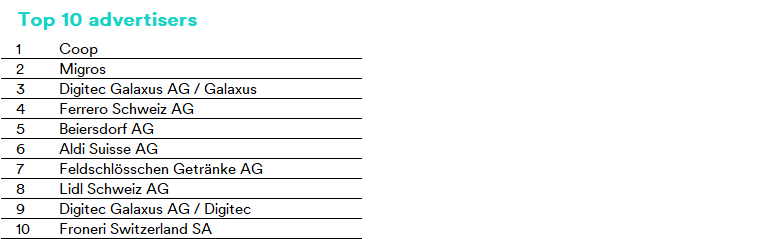

Top advertisers and products

The top advertisers and most advertised products and services (excluding range, image and other advertising) in May

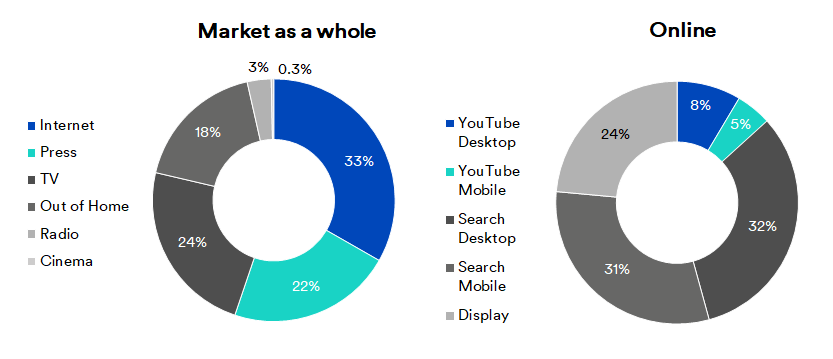

Media mix

Media mix for May 2023

Contact: mediafocus@mediafocus.ch, Tel.: +41 43 322 27 50

Annual review 2022 Advertising Market Trend April