Highlights in June 2023

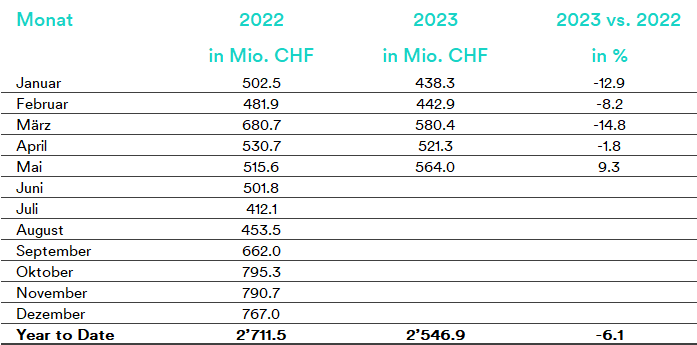

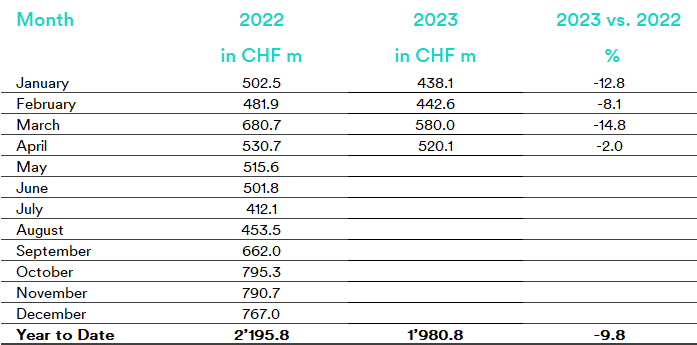

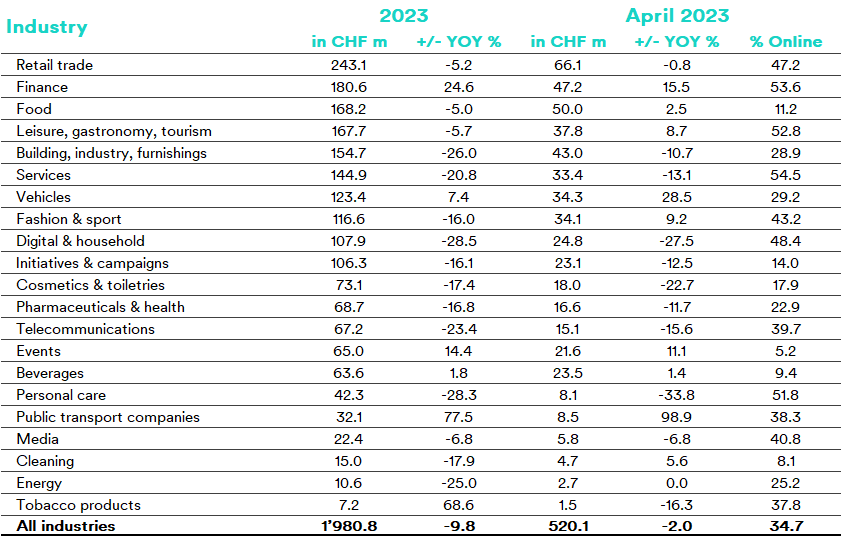

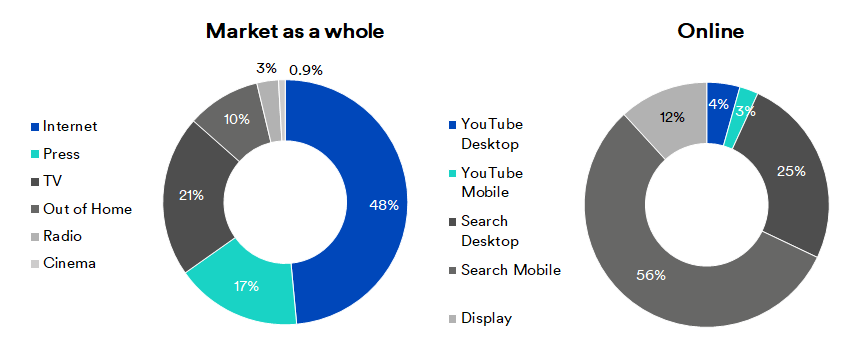

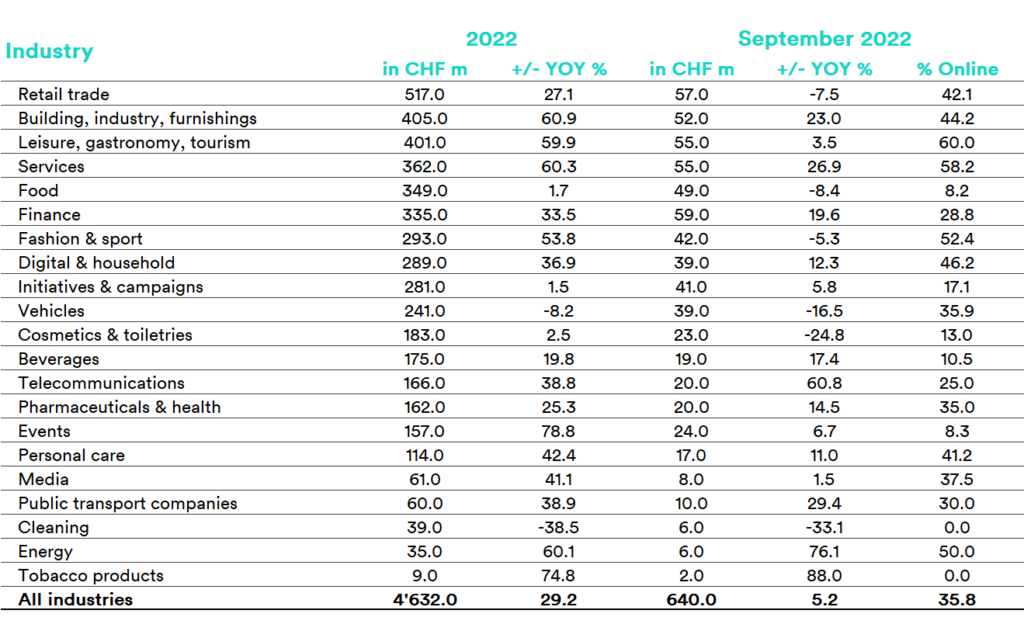

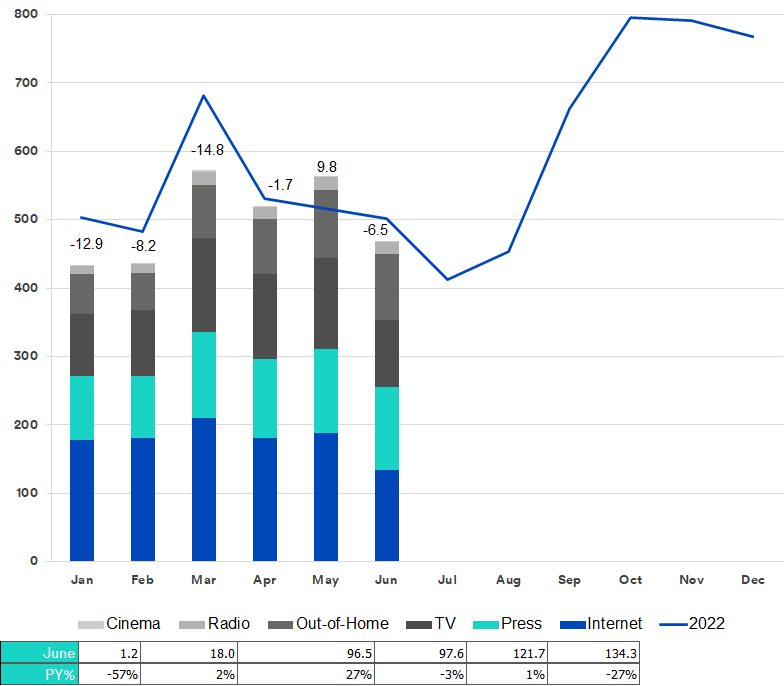

The outcome of the first six months of the advertising year has been revealed – CHF 3,019 million gross. This represents a drop of 6.1 percent. A total of 14 sectors are lagging behind last year’s figures (YTD).

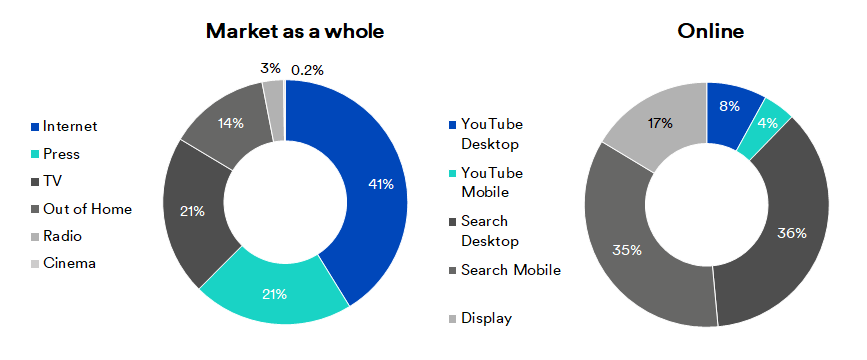

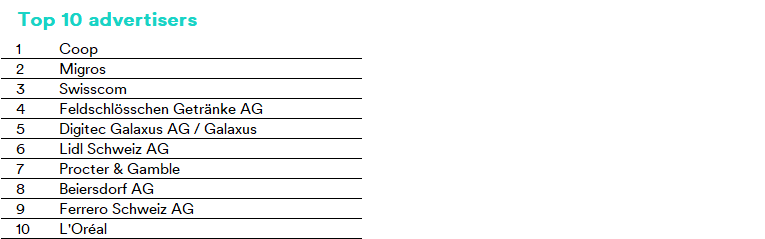

After May’s 9.3 percent rise, the dampening of advertising pressure in June once again heralded the arrival of the summer slowdown. In June, the advertising market showed a drop of 6.5 percent compared to the previous year, closing out at a gross figure of CHF 469 million. This development has certainly been driven by a disproportionate decline in searches*. The conventional channels have actually shown an uptick of 5.7 percent. The biggest influence here was the out-of-home media group, with an increase of 27 percent in comparison with 2022.

*Google has also integrated their AI “Bard” into Google Search since mid-May 2023. As a result, the internal structure of the HTML pages was adjusted in both desktop and mobile search.

We had to follow up on these changes in our system, which in some cases resulted in fewer ads being recorded in June than in previous months. This results in a break in the trend in June 2023. Ad capture is now back to normal levels. We regret the circumstances and will carefully monitor further changes from Google.

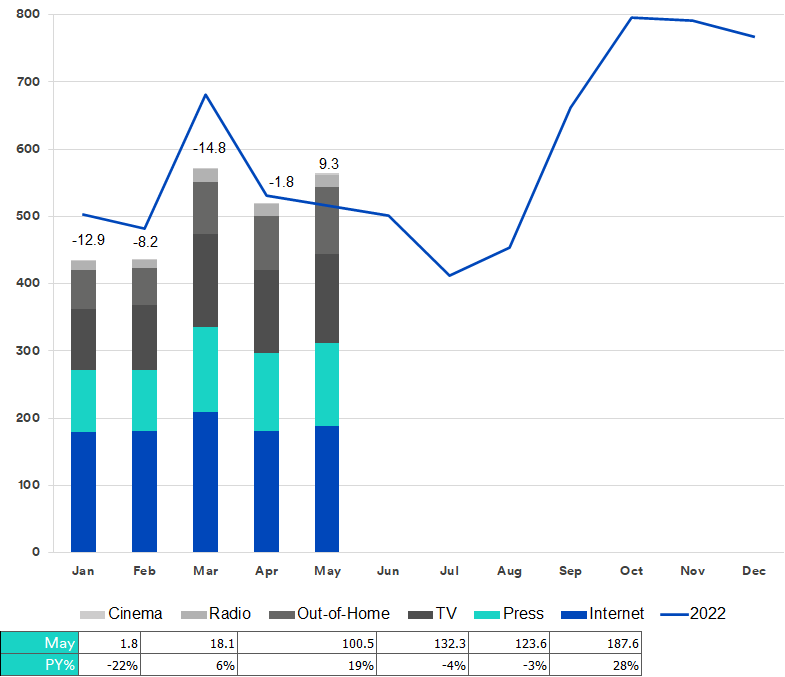

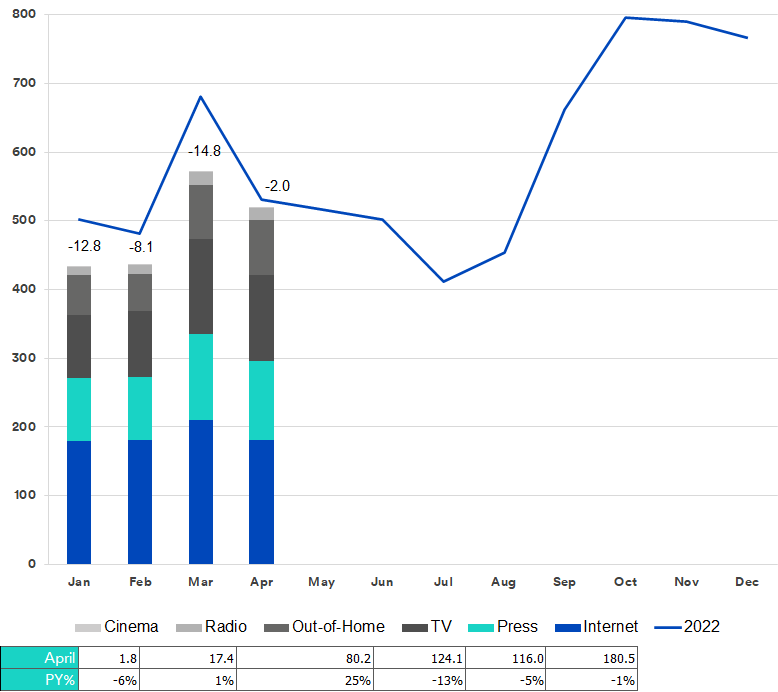

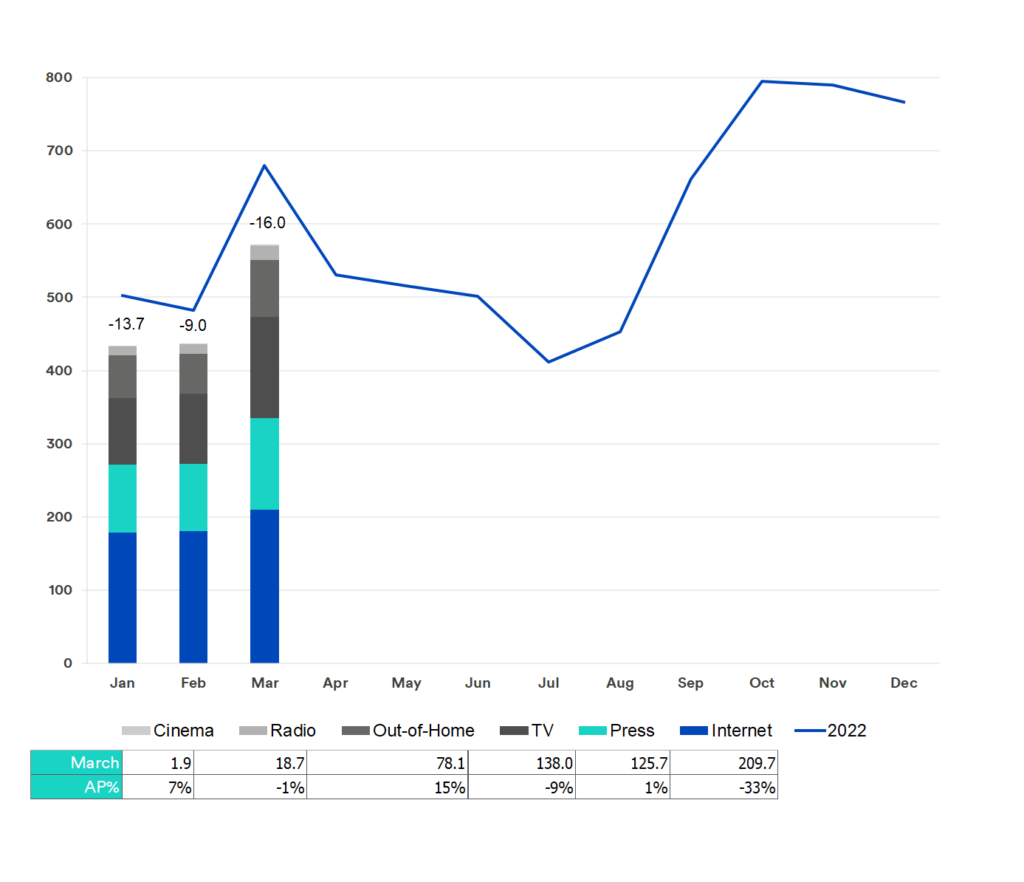

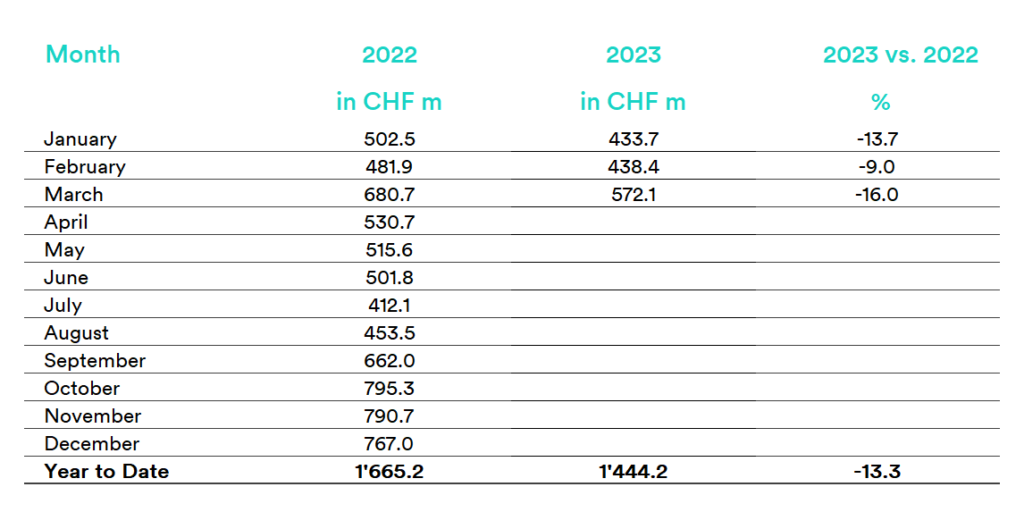

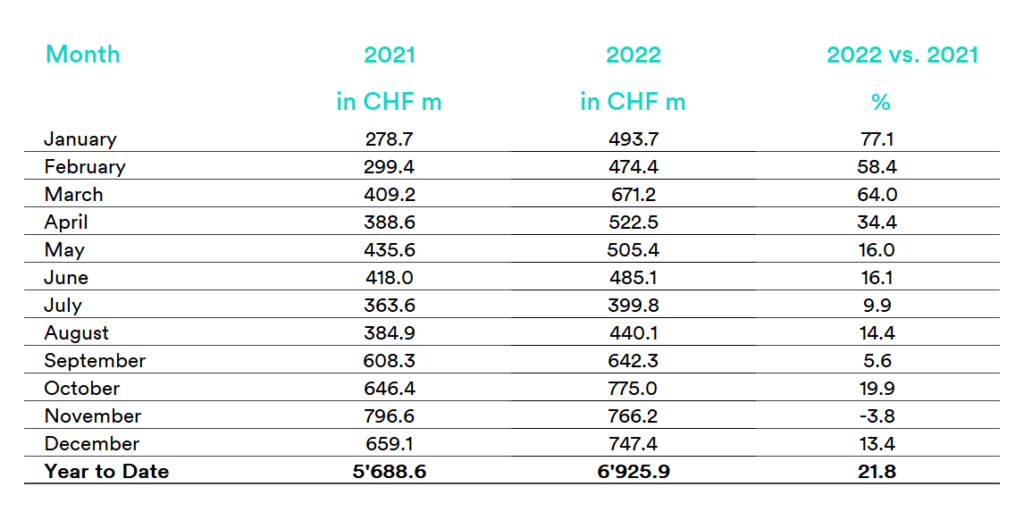

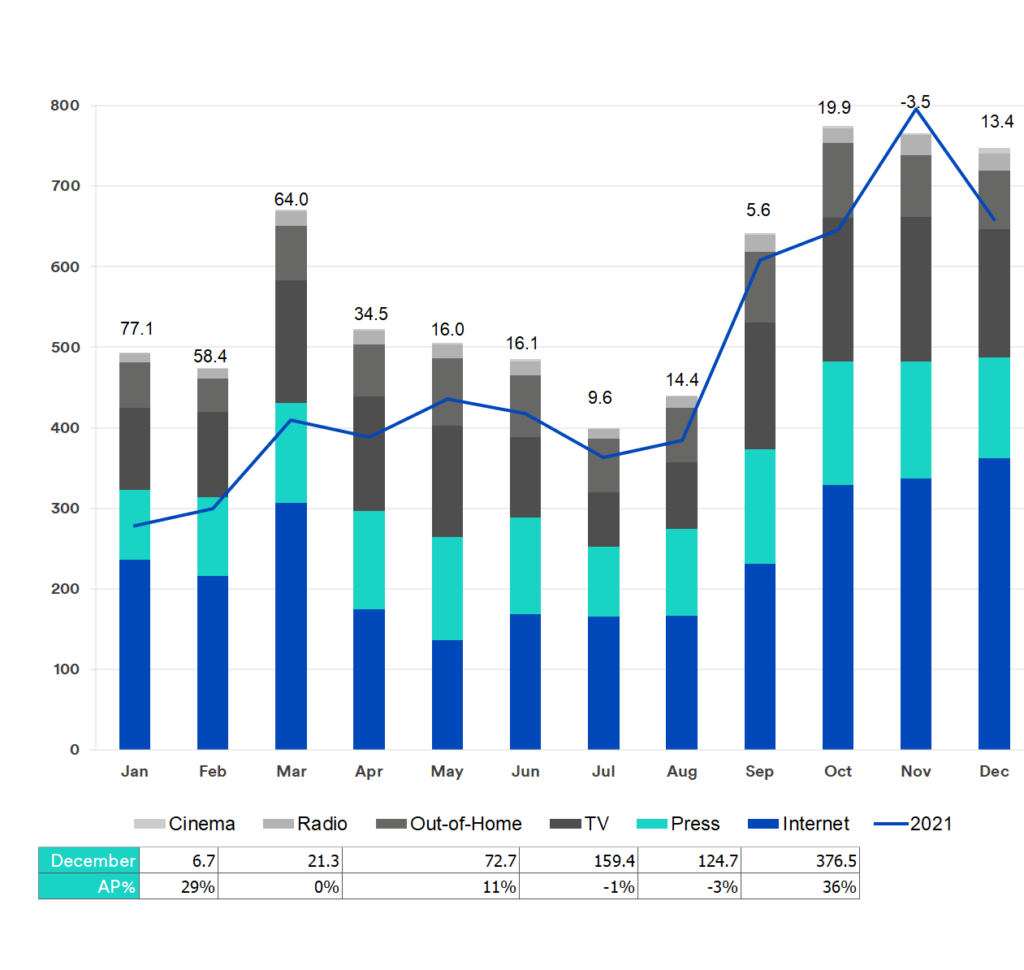

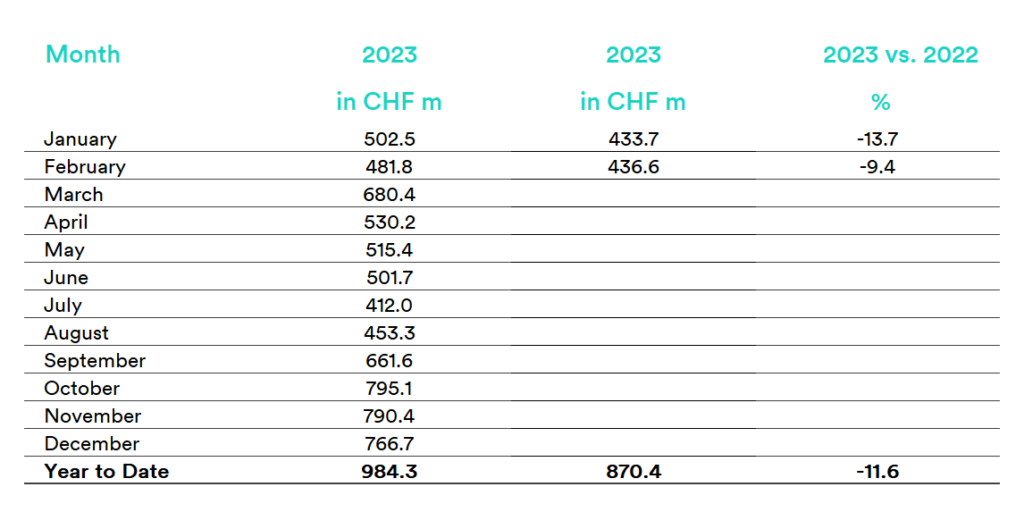

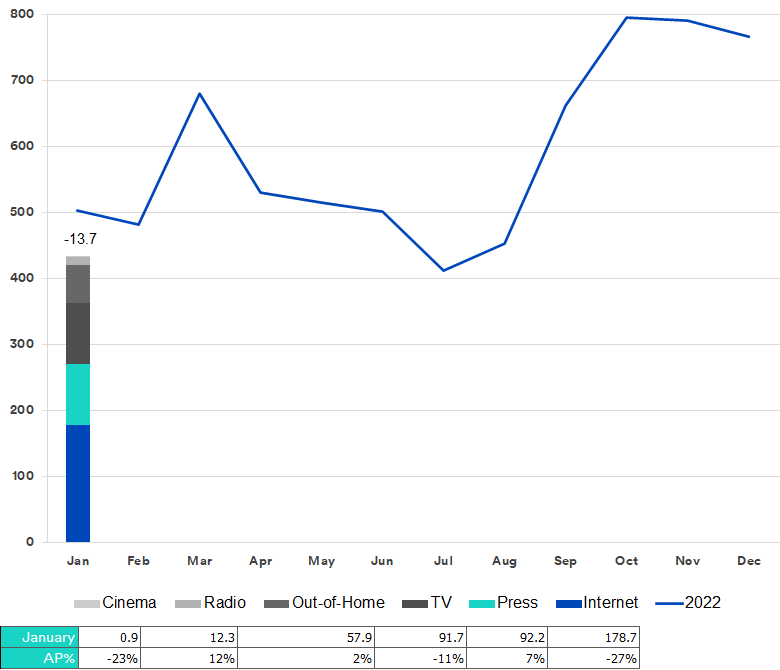

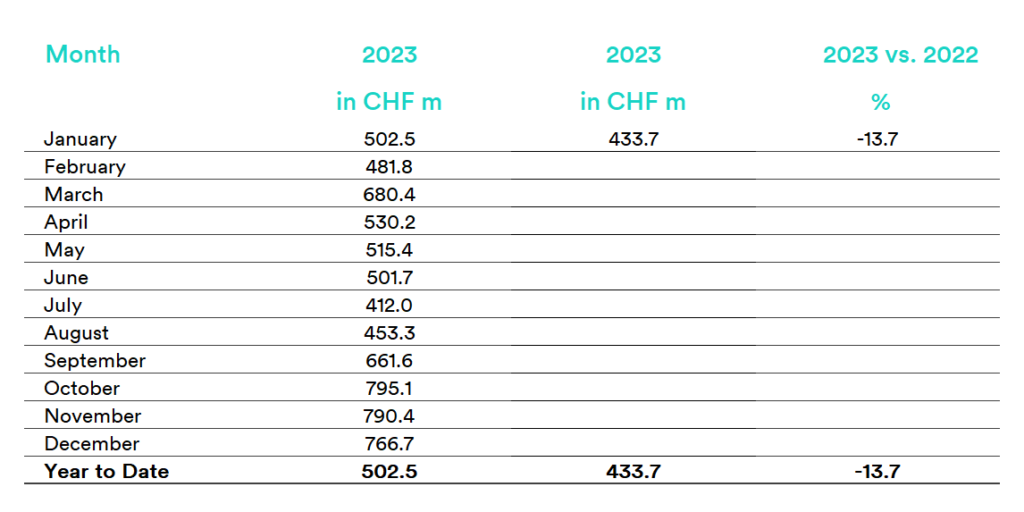

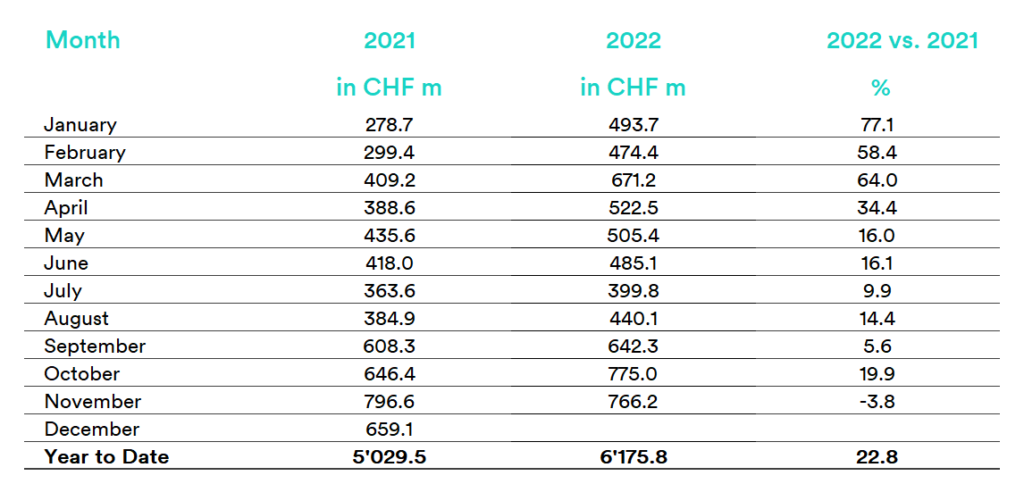

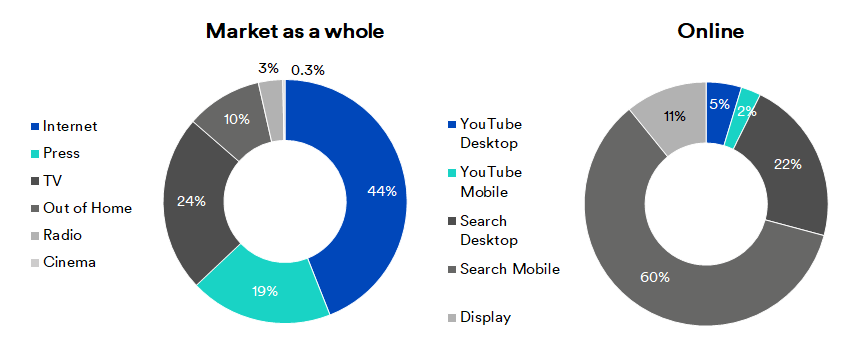

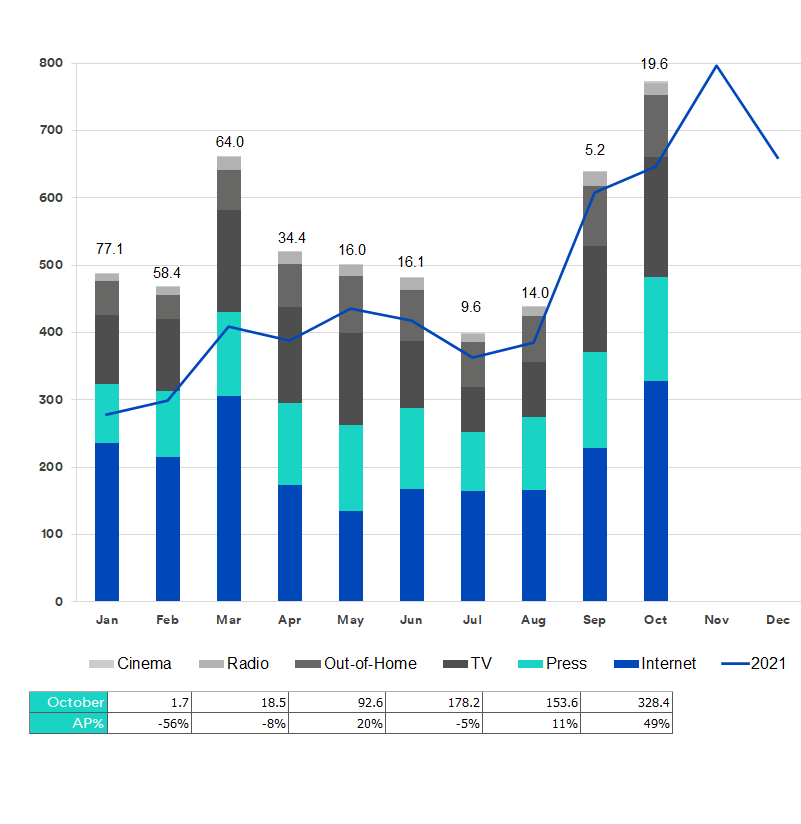

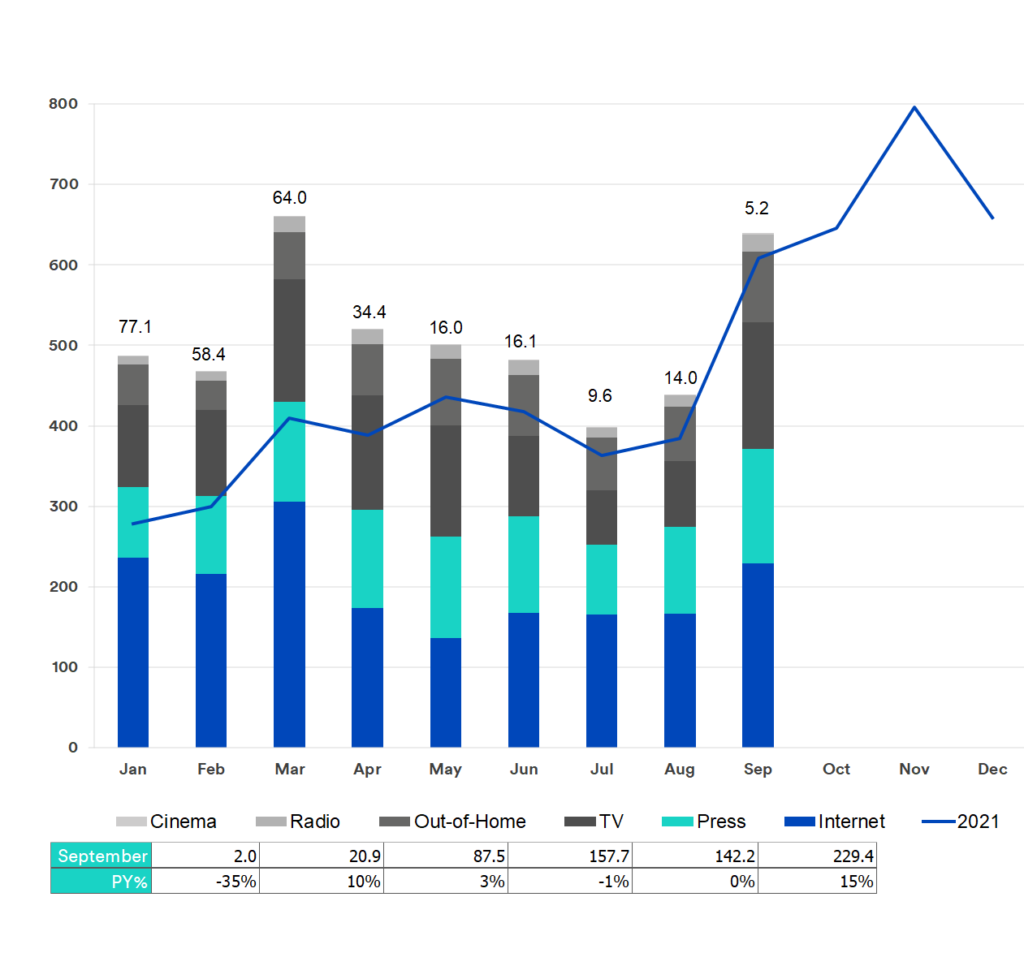

Advertising pressure in the market as a whole

Advertising pressure development up to June 2023 in CHF million gross

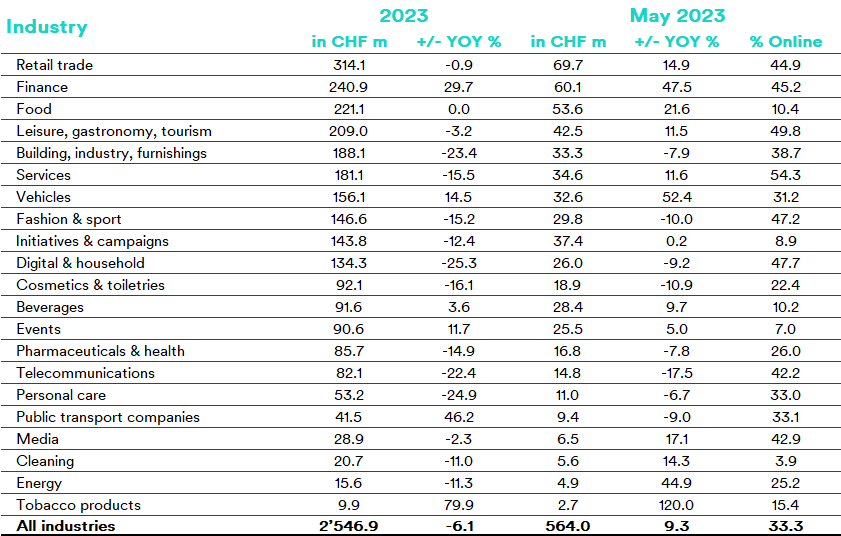

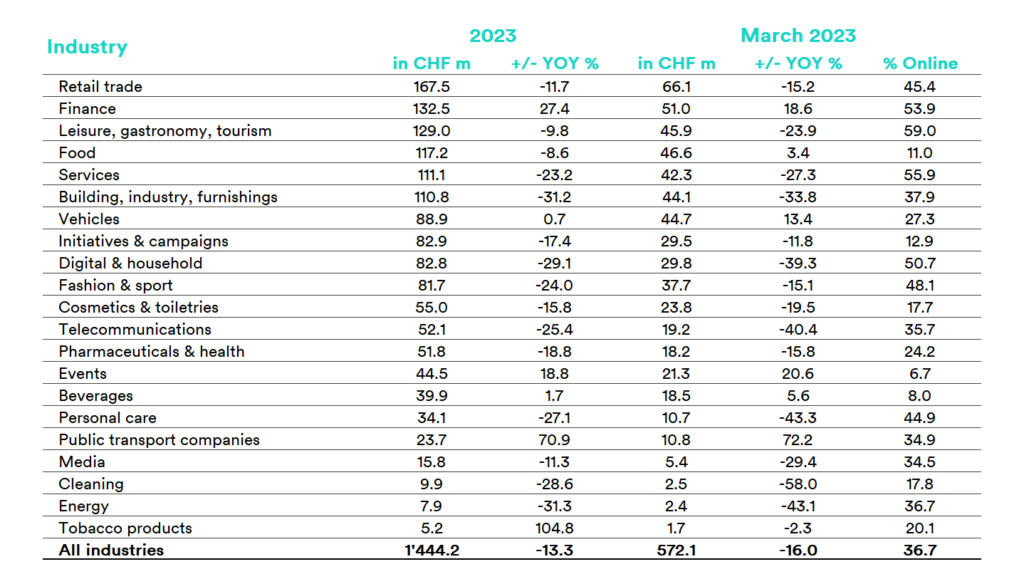

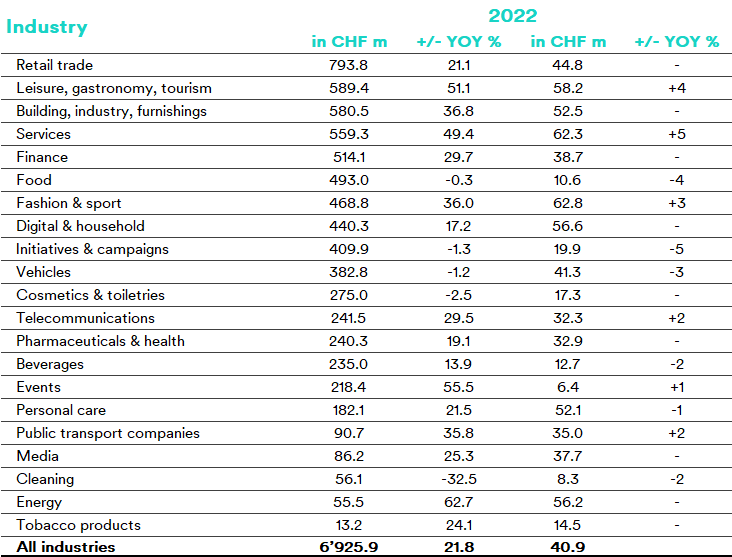

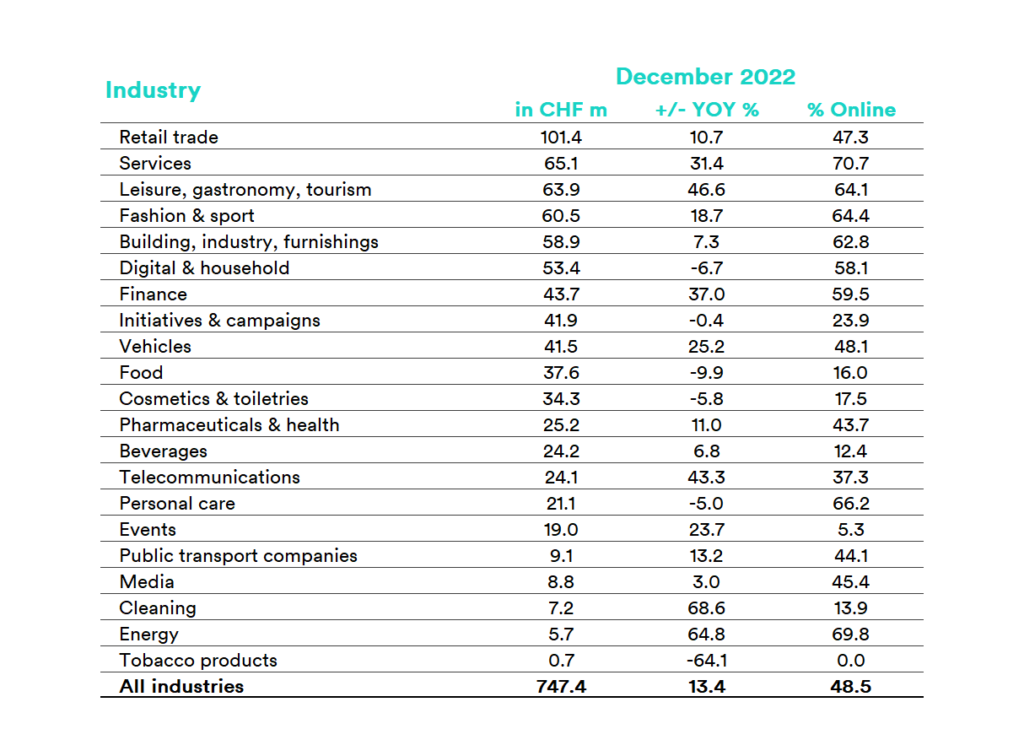

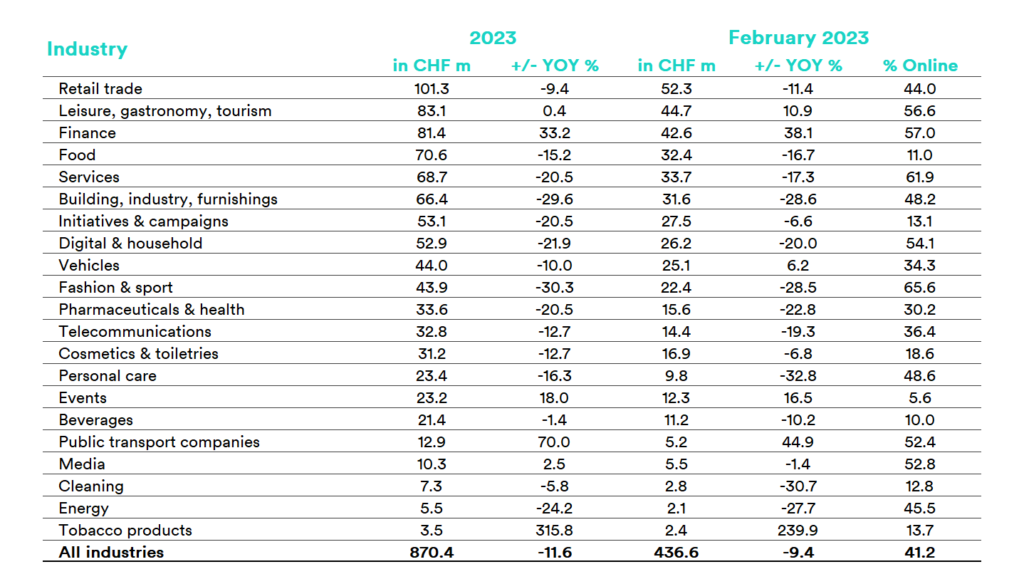

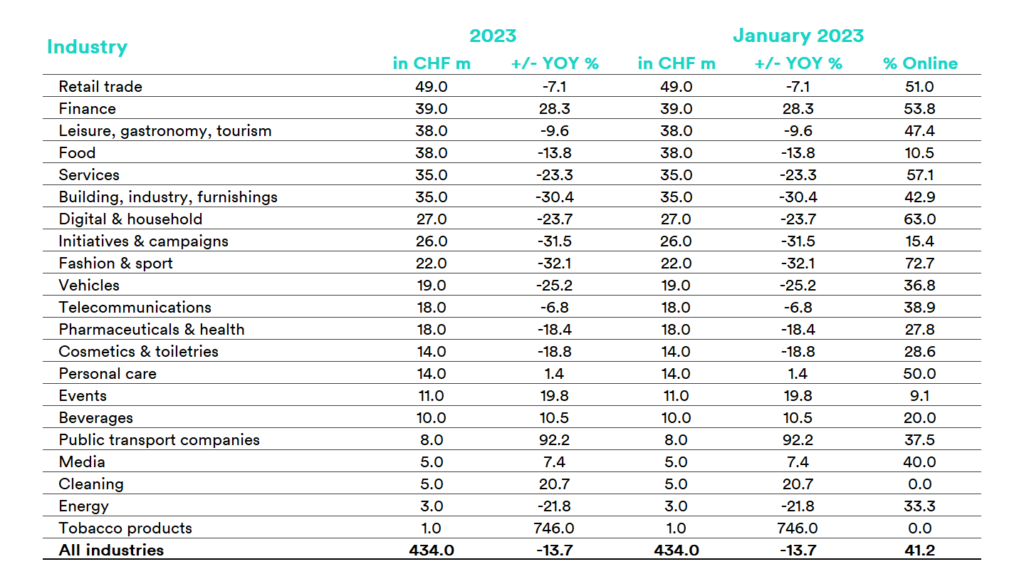

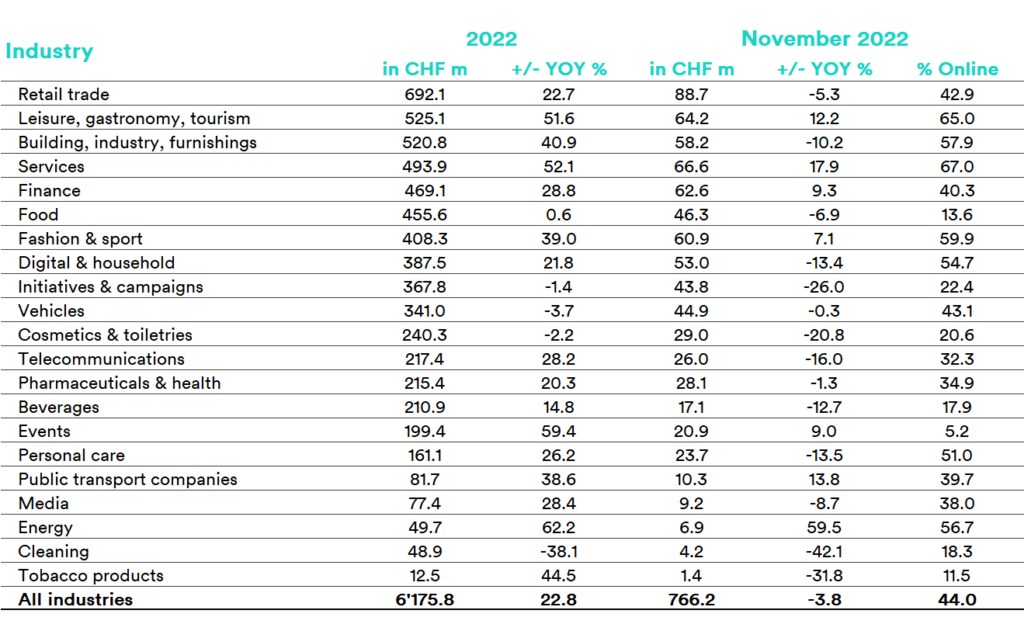

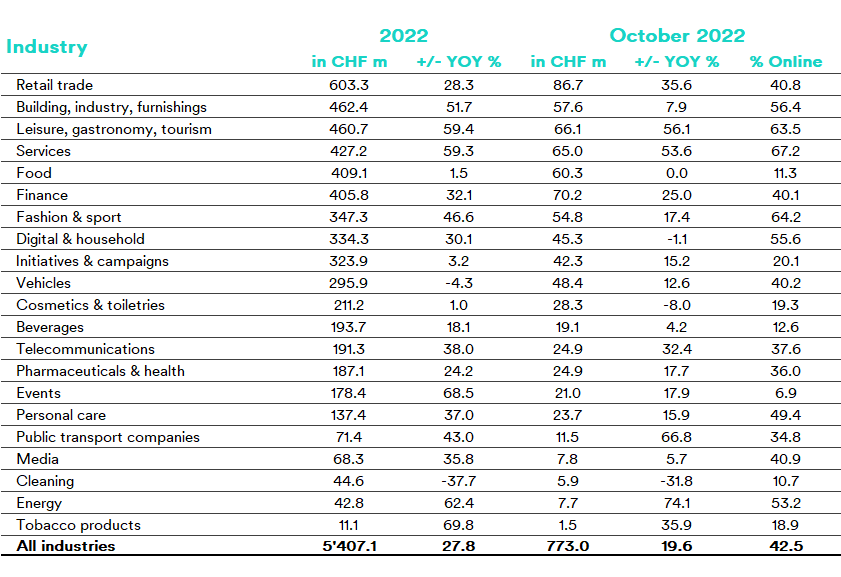

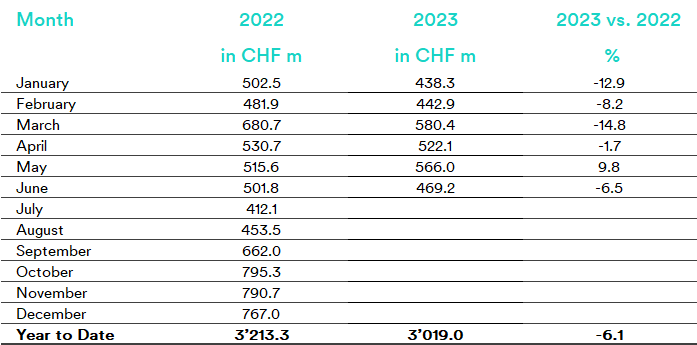

Strong performance in finance in June and in the YTD

In June, the finance sector recorded a significant increase in advertising pressure (+40.3%) and shows a strong presence in the sector ranking for the year to date with a rise of 31.7 percent. This means it comes up in second place in the mid-year financial statements.

Although retail has generated more advertising pressure in the YTD, it stagnated in June (-0.5%). The food industry managed to increase its advertising pressure both in June (+16.1%) and in the YTD (+1.9%), coming in at third place.

Compared to the previous year, only eight sectors achieved an increase in June. The tobacco industry, which, along with a noticeable increase in June (+64.4%), also enjoyed a considerable rise in the YTD (+76.9%), came out on top. With strong campaigns on climate protection legislation, the initiatives & campaigns sector was also able to record an increase (+22.2%), and cleaning also made considerable gains (+48.6%).

Cultural activities, including concerts, open-air shows and sports events such as the Weltklasse Zürich, fired up the events sector, which, like the food industry, rose by 16.1 percent.

Last but not least, advertising pressure in the public transport sector also rose in June (+3.4%).

Nine sectors record double-digit declines

A total of 13 sectors reduced their advertising pressure, and nine of those recorded double-digit declines.

The largest drop can be seen in the energy industry, which showed a decline of 36 percent in terms of advertising pressure. Even the construction, industry and furnishings sector, which made it into the top five in the YTD, saw a considerable drop (-34.8%).

As in May, the fashion and sports sector, with a reduction of 29.9 percent, showed the third-greatest decline, despite coming in at around average in the YoY comparison.

Despite summery temperatures, advertising activities in the leisure, gastronomy and tourism sector – with and without searches – remained quiet (-25.3%). The services sector (-25.0%) was also one of the five sectors with the biggest declines in June.

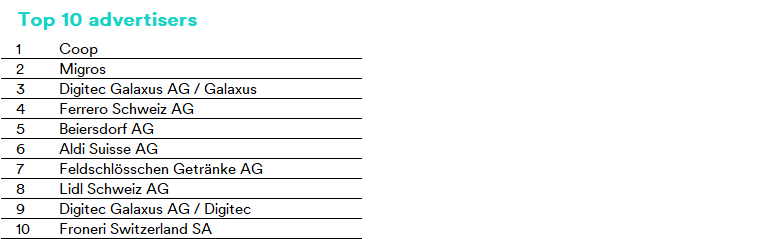

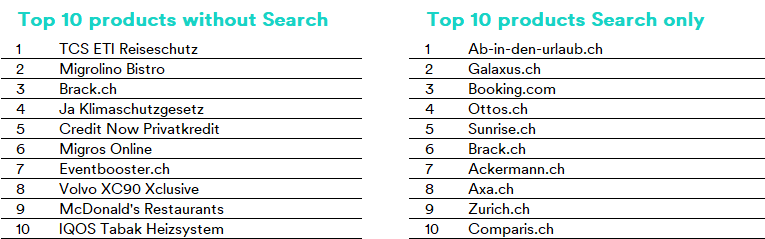

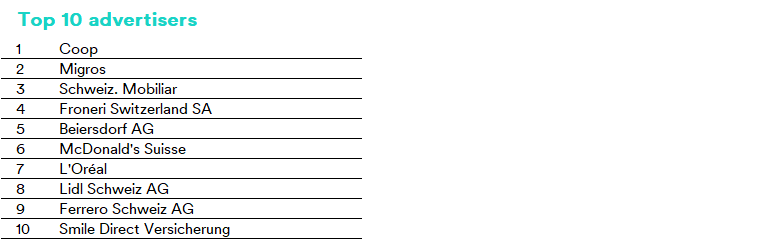

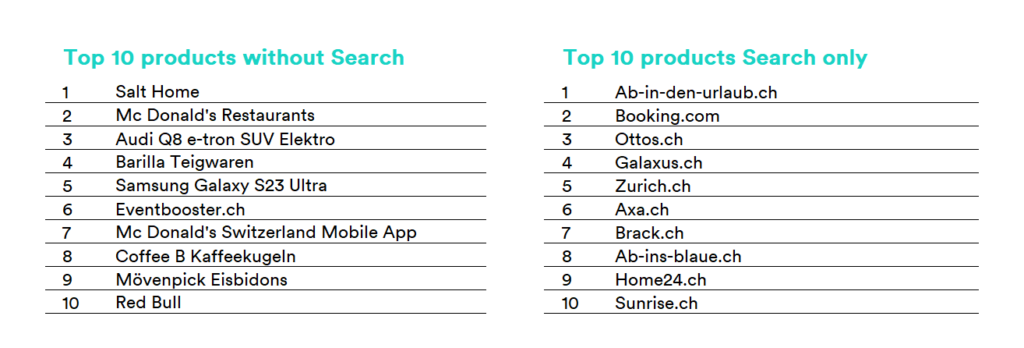

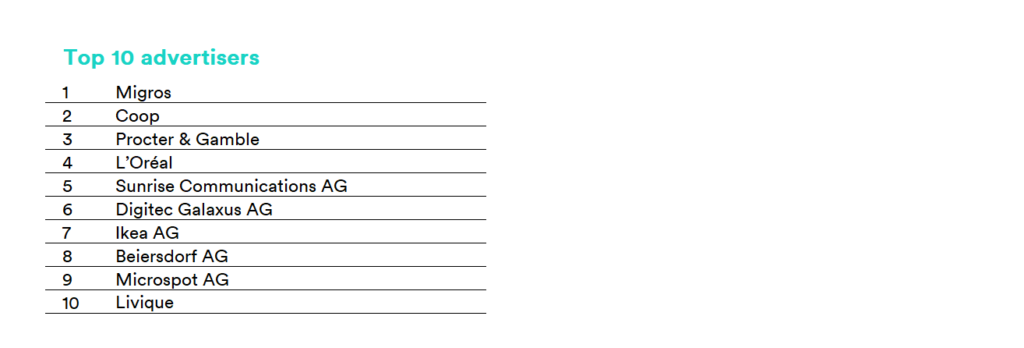

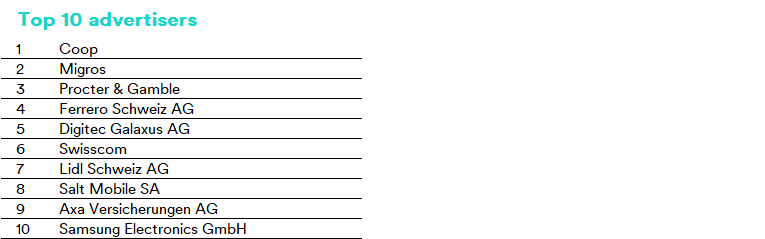

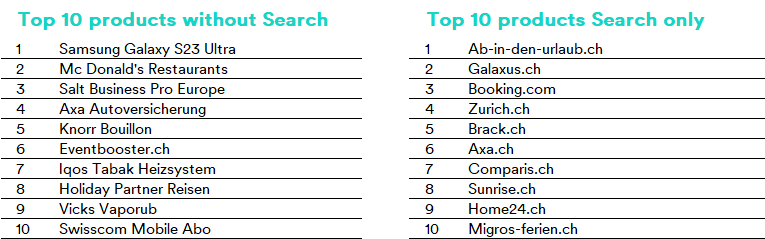

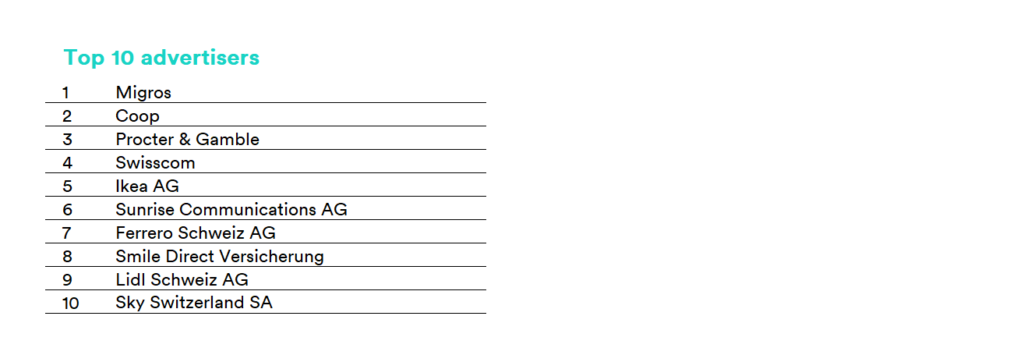

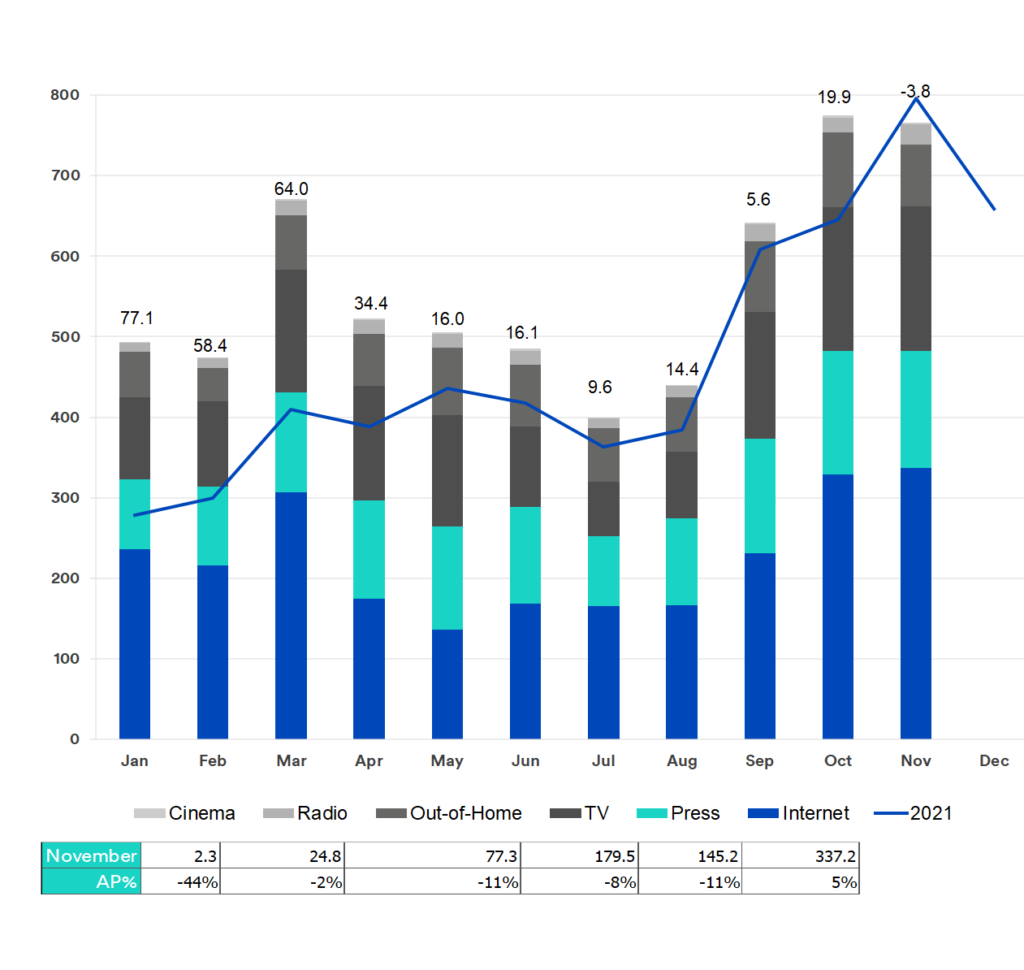

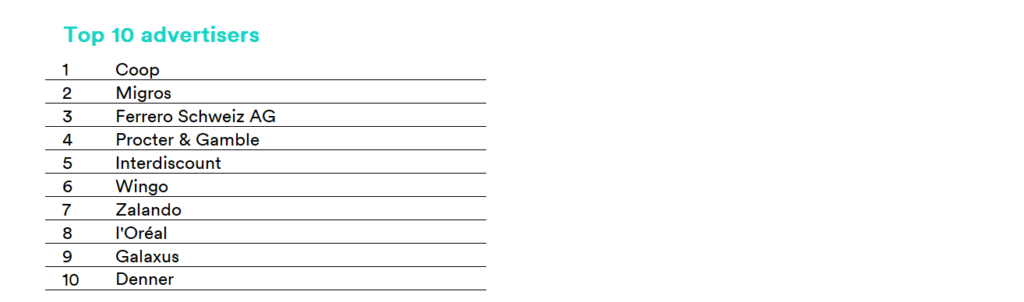

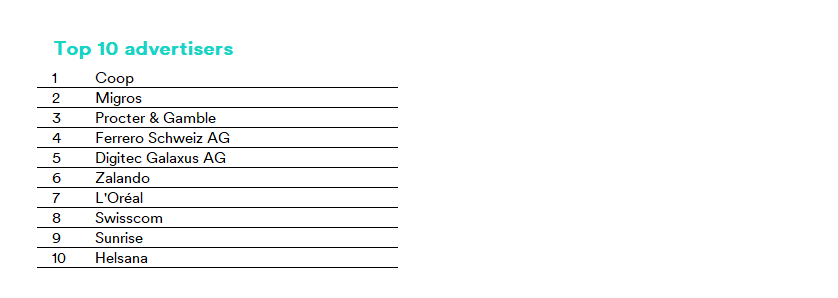

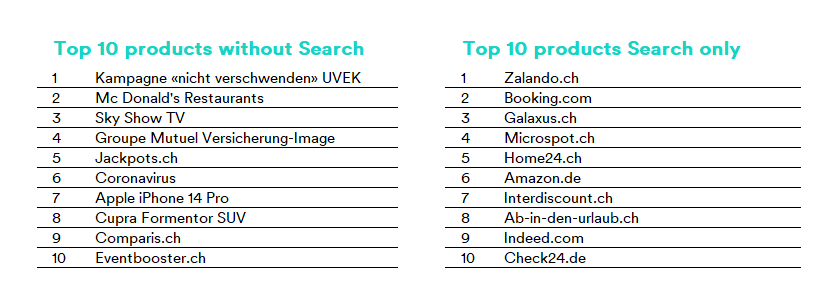

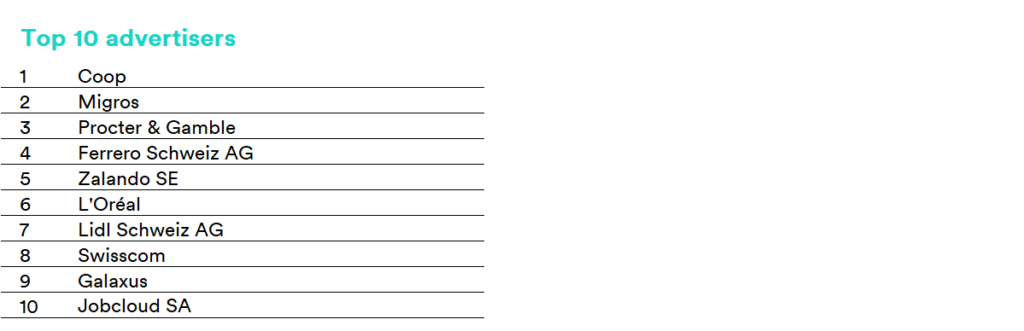

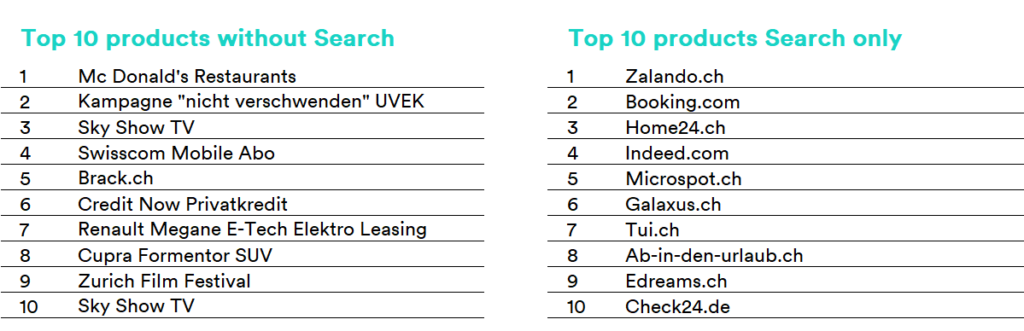

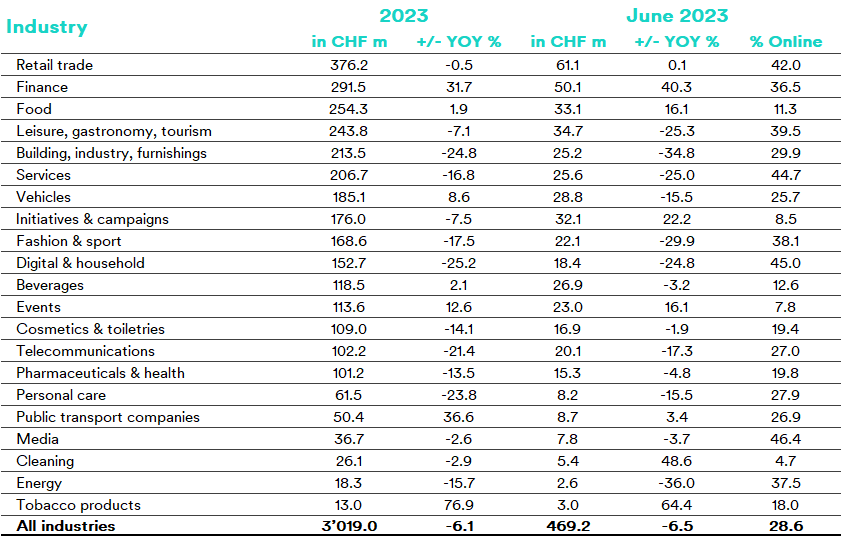

Top advertisers and products

The top advertisers and most advertised products and services (excluding range, image and other advertising) in June

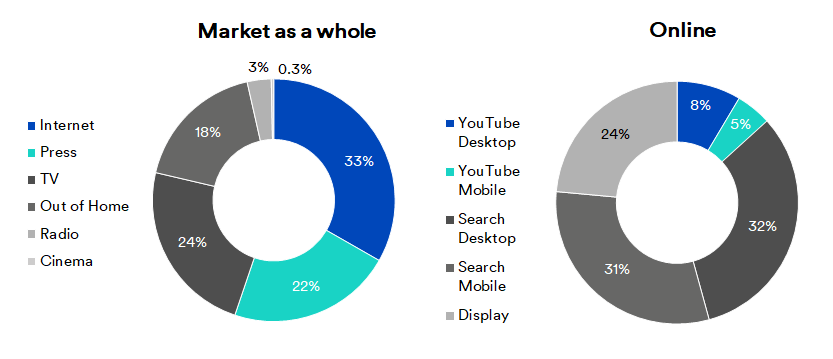

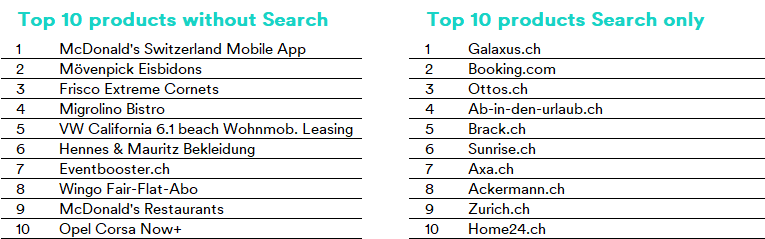

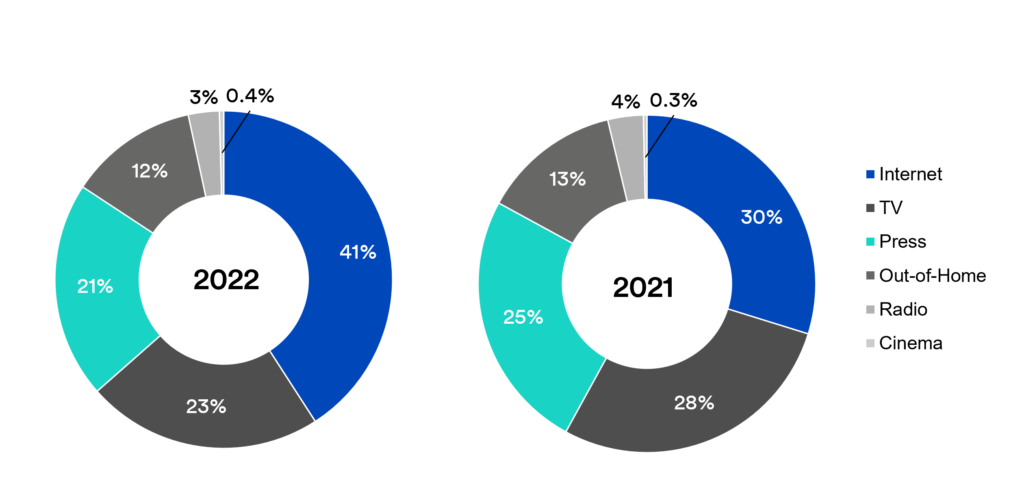

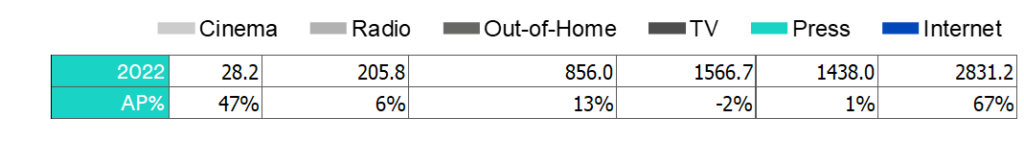

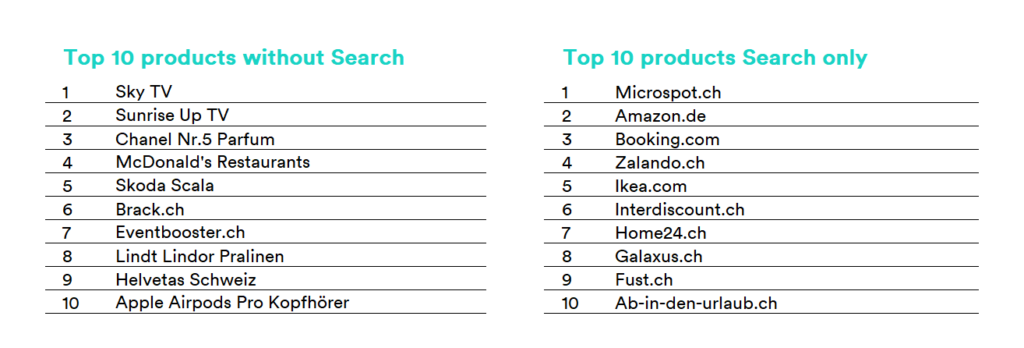

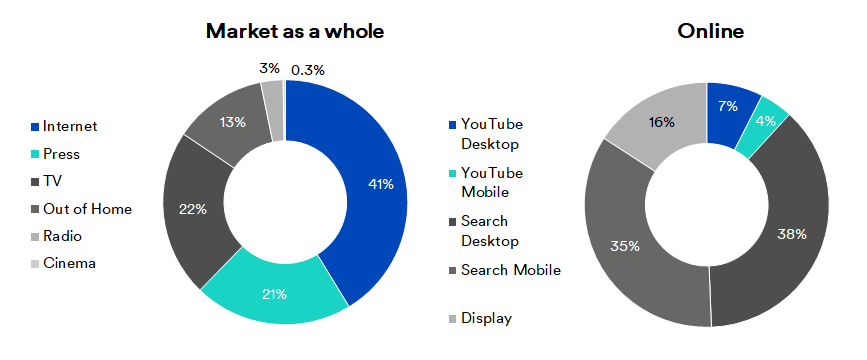

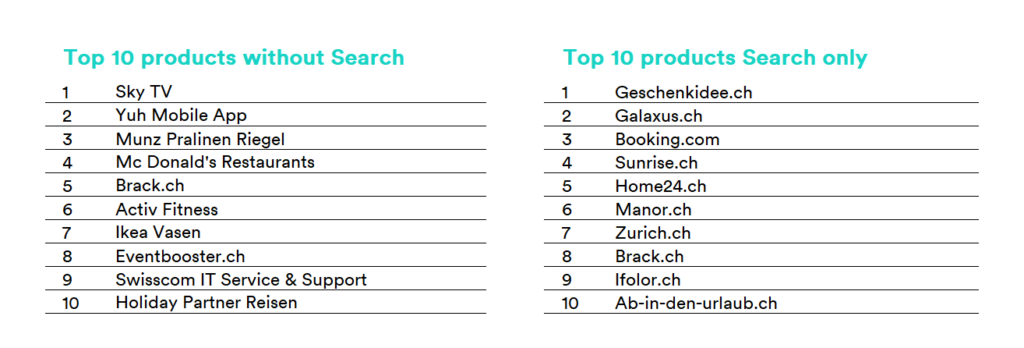

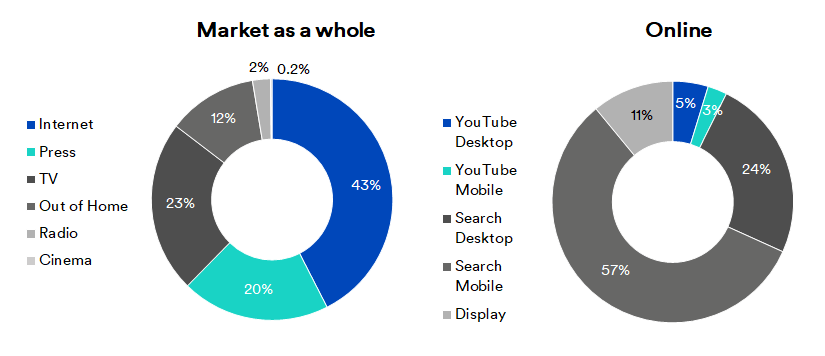

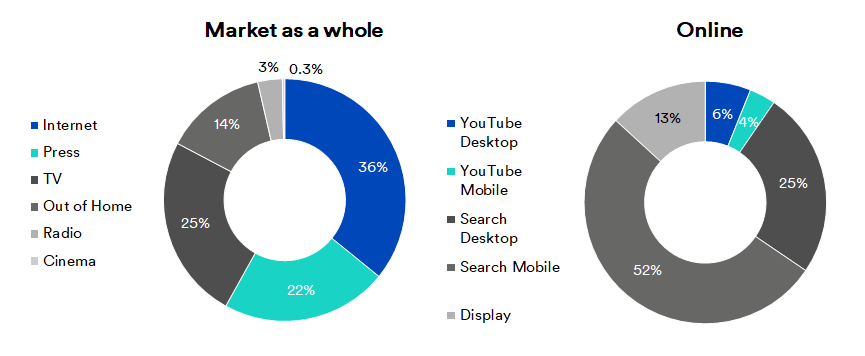

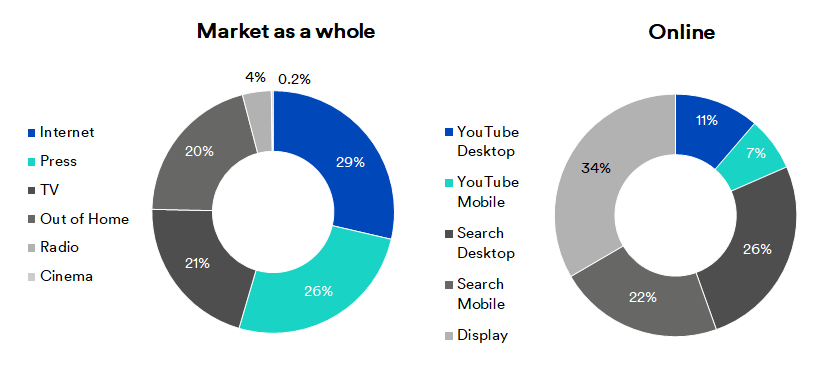

Media mix

Media mix for June 2023

Contact: mediafocus@mediafocus.ch, Tel.: +41 43 322 27 50

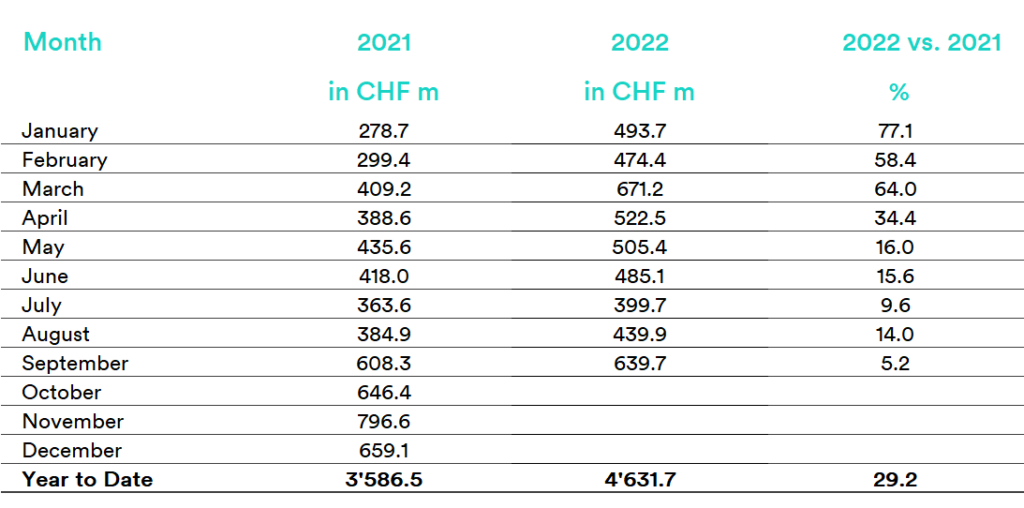

Annual review 2022 Advertising Market Trend May